Mythbuster: Does France really have a 60 percent inheritance tax rate?

When discussing inheritance in France the figure that's often bandied about is the whopping 60 percent inheritance tax rate - but this is not quite as it seems.

'60 percent inheritance tax? No thanks France, I'm not doing that to my kids' - spend much time in expat online forums and it won't be long before you come across comments like that. So does France really have a 60 percent inheritance tax?

Well sort of - the rate exists, but most people won't be paying it.

Here's how it works;

Inheritance tax in France is levied based on your relationship to the deceased - so you pay different rates depending on whether you were the spouse, partner, child, sibling or friend of the person who has left you money or property. There are also different tax-free allowances depending on your relationship.

It's worth pointing out also that France has strict laws on inheritance meaning, for example, that parents cannot disinherit their children - find the full details on that HERE.

So let's say you have been left money, property or other assets by someone in France - here's how much inheritance tax you can expect to pay.

Spouse or partner - If you were married or Pacsé (in a civil partnership) you are exonerated from paying any inheritance tax. Couples who are living together but are not married or pacsé get no special dispensation and pay tax at the standard rates for non-relatives (see below).

Children - For children inheriting from their parents and vice versa, there is no need to pay any tax on an inheritance valued at less than €100,000.

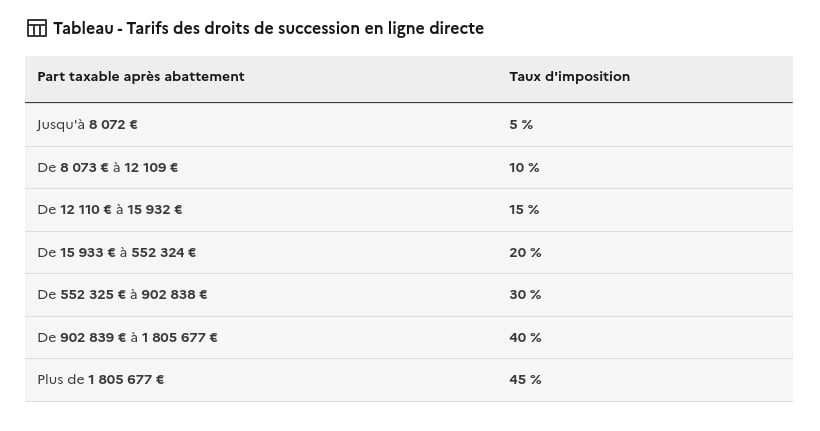

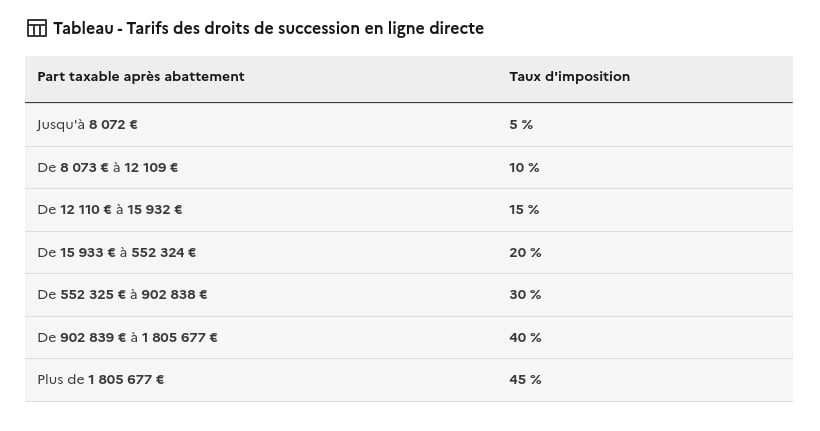

For the part of the inheritance worth more than €100,000, inheritance tax is charged at between five and 45 percent depending on the value - this is charged on a sliding scale so you pay no tax on the first €100,000 then tax on a sliding scale up to 45 percent, although the 45 percent rate would only kick in on the portion of the inheritance worth more than €1.8 million.

It's also worth noting that the tax rate is charged based on the amount you are receiving individually, not the total value of the inheritance.

Adopted children have the same legal rights as biological children.

The below table shows the sliding scale.

Inheritance tax rates for children - full details service-public.fr

Parents - if you are a parent inheriting money or assets from a child, then the same rules apply as children inheriting from their parents. The same is true for grandparents who are inheriting from their grandchildren.

Grandchildren - if you are inheriting money from a grandparent, then the tax is charged on the same sliding scale as for children (as per the table above) but the tax-free allowance is different.

If one or both of your parents are alive, then your tax-free allowance is €1,594 and then after that you begin to pay tax. However if both your parents are dead (or if they have renounced their inheritance) then you benefit from the €100,000 tax-free allowance.

Siblings - if your legacy is from a brother or sister, you pay no inheritance tax if you meet any of the following conditions;

- You have lived with the deceased on a permanent basis in the five years leading up to the death

- You are single, widowed, divorced or separated

- You are older than 50 years old

- You are younger than 50, but have a medical condition that means you cannot work

If you meet none of those conditions, there is an initial tax-free allowance of €15,932, that means that you won't pay any inheritance tax if your legacy is worth less than that.

If your legacy is worth more than that then the first €15,932 is tax free. After that inheritance worth less than €24,430 is taxed at 35 percent. Inheritance worth more than this is taxed at 45 percent.

Nephews/nieces - Nephews and nieces can inherit €7,967 tax free but afterwards must pay an inheritance tax of 55 percent. However, if they are inheriting in the place of a parent who has died, then they face the same inheritance tax regime as siblings.

Wider family - more distant relations such as cousins, great nephews and nieces or great uncles and aunts can inherit up to €1,594 tax free and then must pay a 55 percent inheritance tax on anything above this.

No relation - if you are neither related to the deceased nor married/pacsé with them then this is where that 60 percent inheritance tax rate comes in.

In the case of an inheritance from someone you are not related to, you have a tax-free allowance of just €1,594 and must pay tax on anything above this, at a rate of 60 percent.

This also applies to people who are more distantly related than the categories outlined above - for example second cousins.

This rate is definitely one to watch out for if you are in a couple but are not married or pacsé - leaving something to your partner could also land them with a hefty tax bill. The same is true for step-children who have not been legally adopted, so this is also something to watch out for in blended families.

Other exemptions

If you have a registered disability, the tax free allowance increases by an extra €159,325.

If you were injured in war (to the degree that the French state considers you 50 percent disabled), you can also receive a 50 percent reduction of the amount of tax to be paid on inheritance - although this mostly concerns French nationals who are registered with the state as disabled war veterans.

Loopholes

Foreigners are often tempted by loopholes that claim to minimise the inheritance tax that their descendants will pay - but it's worth checking these carefully before you start.

Firstly ascertain whether your legatees will actually be liable for inheritance tax - if you're leaving money or assets worth less than €100,000 to children - or leaving anything at all to your husband, wife or civil partner - then they won't be paying any inheritance tax anyway so tax loopholes are unnecessary.

And remember that the inheritance tax rate is based on the size of each inheritance, not the total value of the estate - so if your French property is worth €150,000 but you're leaving it to your two children, then each of them will remain within the tax-free allowance.

If you feel that an alternative arrangement would help, then check out carefully what it involves - for example if you register your French holiday home as being owned by a business or a limited company then that will put you into the world of annual tax reporting for business while you are alive - a complicated process.

Likewise setting up an SCI (a type of limited company) to own a holiday home creates problems with the property tax declaration - full details here.

This article is intended as an overview of the French tax system and should not be taken as a substitute for legal advice. Anyone in a complicated situation is strongly advised to take independent advice from a specialist in French tax and inheritance law.

Comments (1)

See Also

'60 percent inheritance tax? No thanks France, I'm not doing that to my kids' - spend much time in expat online forums and it won't be long before you come across comments like that. So does France really have a 60 percent inheritance tax?

Well sort of - the rate exists, but most people won't be paying it.

Here's how it works;

Inheritance tax in France is levied based on your relationship to the deceased - so you pay different rates depending on whether you were the spouse, partner, child, sibling or friend of the person who has left you money or property. There are also different tax-free allowances depending on your relationship.

It's worth pointing out also that France has strict laws on inheritance meaning, for example, that parents cannot disinherit their children - find the full details on that HERE.

So let's say you have been left money, property or other assets by someone in France - here's how much inheritance tax you can expect to pay.

Spouse or partner - If you were married or Pacsé (in a civil partnership) you are exonerated from paying any inheritance tax. Couples who are living together but are not married or pacsé get no special dispensation and pay tax at the standard rates for non-relatives (see below).

Children - For children inheriting from their parents and vice versa, there is no need to pay any tax on an inheritance valued at less than €100,000.

For the part of the inheritance worth more than €100,000, inheritance tax is charged at between five and 45 percent depending on the value - this is charged on a sliding scale so you pay no tax on the first €100,000 then tax on a sliding scale up to 45 percent, although the 45 percent rate would only kick in on the portion of the inheritance worth more than €1.8 million.

It's also worth noting that the tax rate is charged based on the amount you are receiving individually, not the total value of the inheritance.

Adopted children have the same legal rights as biological children.

The below table shows the sliding scale.

Parents - if you are a parent inheriting money or assets from a child, then the same rules apply as children inheriting from their parents. The same is true for grandparents who are inheriting from their grandchildren.

Grandchildren - if you are inheriting money from a grandparent, then the tax is charged on the same sliding scale as for children (as per the table above) but the tax-free allowance is different.

If one or both of your parents are alive, then your tax-free allowance is €1,594 and then after that you begin to pay tax. However if both your parents are dead (or if they have renounced their inheritance) then you benefit from the €100,000 tax-free allowance.

Siblings - if your legacy is from a brother or sister, you pay no inheritance tax if you meet any of the following conditions;

- You have lived with the deceased on a permanent basis in the five years leading up to the death

- You are single, widowed, divorced or separated

- You are older than 50 years old

- You are younger than 50, but have a medical condition that means you cannot work

If you meet none of those conditions, there is an initial tax-free allowance of €15,932, that means that you won't pay any inheritance tax if your legacy is worth less than that.

If your legacy is worth more than that then the first €15,932 is tax free. After that inheritance worth less than €24,430 is taxed at 35 percent. Inheritance worth more than this is taxed at 45 percent.

Nephews/nieces - Nephews and nieces can inherit €7,967 tax free but afterwards must pay an inheritance tax of 55 percent. However, if they are inheriting in the place of a parent who has died, then they face the same inheritance tax regime as siblings.

Wider family - more distant relations such as cousins, great nephews and nieces or great uncles and aunts can inherit up to €1,594 tax free and then must pay a 55 percent inheritance tax on anything above this.

No relation - if you are neither related to the deceased nor married/pacsé with them then this is where that 60 percent inheritance tax rate comes in.

In the case of an inheritance from someone you are not related to, you have a tax-free allowance of just €1,594 and must pay tax on anything above this, at a rate of 60 percent.

This also applies to people who are more distantly related than the categories outlined above - for example second cousins.

This rate is definitely one to watch out for if you are in a couple but are not married or pacsé - leaving something to your partner could also land them with a hefty tax bill. The same is true for step-children who have not been legally adopted, so this is also something to watch out for in blended families.

Other exemptions

If you have a registered disability, the tax free allowance increases by an extra €159,325.

If you were injured in war (to the degree that the French state considers you 50 percent disabled), you can also receive a 50 percent reduction of the amount of tax to be paid on inheritance - although this mostly concerns French nationals who are registered with the state as disabled war veterans.

Loopholes

Foreigners are often tempted by loopholes that claim to minimise the inheritance tax that their descendants will pay - but it's worth checking these carefully before you start.

Firstly ascertain whether your legatees will actually be liable for inheritance tax - if you're leaving money or assets worth less than €100,000 to children - or leaving anything at all to your husband, wife or civil partner - then they won't be paying any inheritance tax anyway so tax loopholes are unnecessary.

And remember that the inheritance tax rate is based on the size of each inheritance, not the total value of the estate - so if your French property is worth €150,000 but you're leaving it to your two children, then each of them will remain within the tax-free allowance.

If you feel that an alternative arrangement would help, then check out carefully what it involves - for example if you register your French holiday home as being owned by a business or a limited company then that will put you into the world of annual tax reporting for business while you are alive - a complicated process.

Likewise setting up an SCI (a type of limited company) to own a holiday home creates problems with the property tax declaration - full details here.

This article is intended as an overview of the French tax system and should not be taken as a substitute for legal advice. Anyone in a complicated situation is strongly advised to take independent advice from a specialist in French tax and inheritance law.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.